COVID-19 is driving an increase in offshore wealth

GlobalData’s 2020 Global Wealth Managers Survey found the industry predicting a widespread increase in the proportion of HNW investor wealth expected to be offshored over the next 12 months, with the COVID-19 pandemic and resulting volatility a key driver. GlobalData Financial Services writes

As part of our tracking of private wealth management industry conditions in the world’s key financial centres, GlobalData surveys wealth managers on the state of offshore wealth management.

This year’s survey was conducted in Q2, after the hard lockdowns of March and April started to end in many countries. The survey found an offshore sector poised for growth as HNW investors flee volatility in their home markets.

A net 50% of wealth managers expect the amount of wealth that private wealth clients manage offshore to increase over the next 12 months – the highest figure we have recorded since we started asking the question in the aftermath of the global financial crisis.

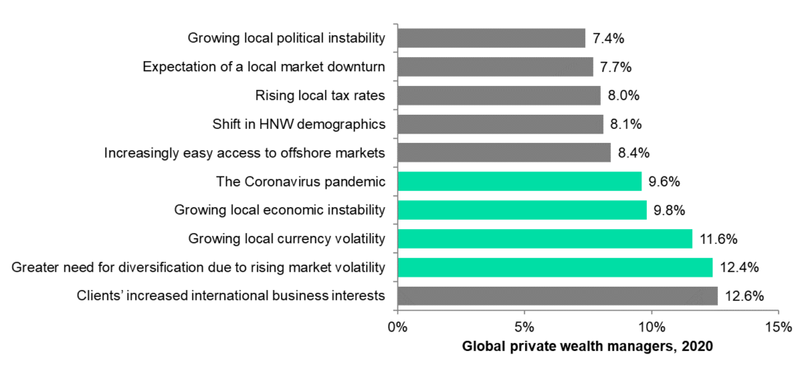

The main drivers in 2020 are unsurprisingly related to the effects of the COVID-19 pandemic. While long-term factors such as international business connections and demographics do play a role, four of the top drivers are related to economic issues pertaining to COVID-19, including market and currency volatility.

Clearly, a flight to safety is occurring. This drive for stability – in a year known for its unpleasant surprises – is hardly shocking. Onshore wealth managers need to address the underlying need for stability in their own product suite if they hope to stem the flow of wealth to offshore centres known for their safe haven status.

The pandemic’s volatility, rather than the virus itself, is driving wealth offshore

Source: GlobalData’s 2020 Global Wealth Managers Survey