CRYPTO

Crypto

Are Bitcoin and cryptocurrencies worth investing in?

Are Bitcoins a good investment today? This is a question many investors are asking as the price of Bitcoin continues along its volatile path.

Are bitcoins a good investment today? This is a question many investors are asking as the price of Bitcoin continues along its volatile path.

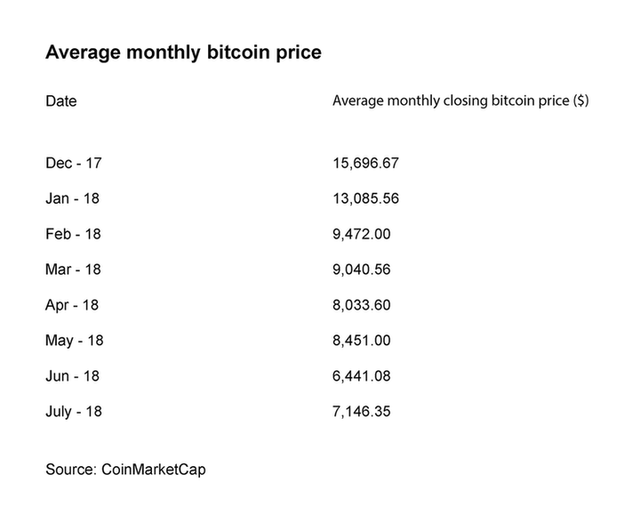

This is significantly below its peak price of around $20,000 in December 2017.

It recovered slightly over the throughout the summer and the price as this article went to press was just above the $5,000 mark.

Bitcoin was the first and is the most popular cryptocurrency. However it is far from the only one, with other cryptocurrencies rising and falling in line with Bitcoin’s price.

Here is why you should still care about cryptocurrencies:

1. Institutional investors are interested in them.

Several major institutions have displayed an interest in accepting cryptocurrencies as a method of payment. Facebook launched a cryptocurrency index in May, the Intercontinental Exchange recently announced that it was setting up a new firm called Bakkt in November to provide regulated bitcoin.

Should major companies start using cryptocurrencies for payments, then the likes of Bitcoin will no longer be viewed as simply an investment, but a proper currency as well.

2. Now is a good time to buy

Since Bitcoin prices have been falling, it is a good time to buy and cash in the profits at a later day. The bitcoin price in 2017 showed more stability, than gold, Japanese yen and the US stock index, which are key indicators of the health of the global economy.

3. They are going mainstream and are set to replace paper money

Several economies are shifting towards digital payment and a cashless economy. Sweden is looking to build its national e-krona. In Venezuela the price of oil is linked to cryptocurrencies due to tough economic sanctions and an unstable Bolivar currency.

But investing in Bitcoin is not the only way to make money. Ever thought of investing in its infrastructure or in mining instead?

Invest in Bitcoin mining

Bitcoin mining is the process by which new units of cryptocurrency are created.

Bitcoin mining typically includes two functions. One is adding transactions to the blockchain - the distributed ledger technology behind cryptocurrencies - and releasing new units of currency.

In the case of Bitcoin, these miners use specific software to solve algorithms and quantitative problems and are rewarded a number of bitcoins in exchange.

Theoretically anybody can become a Bitcoin miner provided they have enough computing power.

However, over time, the blockchain technology has become so advanced that miners need buy professional-grade equipment do the job and profit.

As Vlad Policovsky, partner of UK-based Bitcoin mining firm Picatrix Consulting says: “Forget Bitcoin, invest in Bitcoin infrastructure”.

He adds: “There’s no certainty at this point which cryptocurrency will still be around in two, five, 10 years. But the blockchain technology is here to stay. So that’s where we are investing.”

Policovsky began Bitcoin mining in 2015, and the lucrative opportunities he sought compelled him to quit his job and found Picantrix Consulting, which sets up and operates Bitcoin farms.

In October 2018, he shifted his business into a data centre which has 64 mining computers in Croydon, South London.