Strategy

Wealth management set for banner year in 2021

Wealth managers see brighter times ahead despite lingering COVID-19 impacts. Wealth managers in GlobalData’s latest industry poll from H1 2021 are cautiously optimistic regarding industry conditions for the rest of 2021. Andrew Haslip writes

W

ealth management as an industry was spared the brunt of COVID-19 impact in 2020, although the negative economic conditions were not ideal for minting new affluent investors.

Inflows remained positive for the vast majority of the industry and profitability was up at the world’s leading wealth managers. For example, UBS reported a pre-tax profit of $4.1bn in 2020 – up 20.4% on an already strong 2019.

Yet the pandemic did dent wealth managers’ confidence, with GlobalData’s 2020 Global Wealth Managers Survey (conducted in Q3 2020) finding 60% anticipating a hit to profits and 69% expecting an increase in customer churn. These were strong majorities for pessimism even after the lifting of the strictest lockdowns.

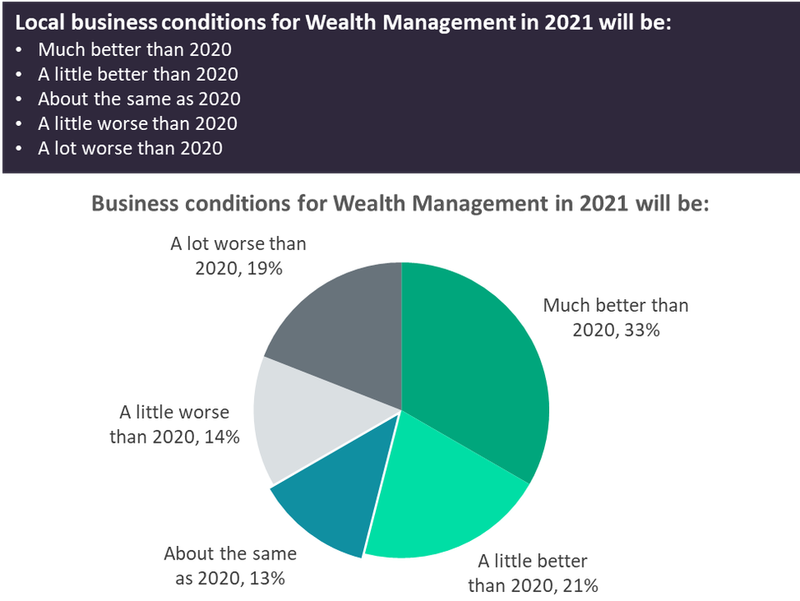

As such, it is striking that 54% of wealth managers in GlobalData’s Industry Poll H1 2021 see brighter conditions ahead – almost double those expressing pessimistic views, as detailed in the chart below. This might not be an industry consensus, but the findings do suggest the wealth space has turned the corner on COVID-19. If profits grew by a fifth in 2020 despite the gloom, just imagine what is in store for 2021.

Growth in the Chinese wealth market will drive affluent population growth in 2021

The China wealth market remains resilient and will continue to grow despite the impact of COVID-19, driving the Chinese mainland affluent population growth. Ravi Sharma writes.

As ground zero of the COVID-19 pandemic, China was always going to suffer some ill effects in its own retail savings and investments markets in 2020. The exceptionally strong growth in financial assets enjoyed by the affluents in China in recent years did see a slight dip in early 2020, as its early pandemic control measures bit into economic activity, while its trade dispute with the US caused additional disruption.

This population, including mass affluent investors (holding liquid assets of $50,000–1m) and high-net-worth individuals (holding liquid assets of more than $1m), is expected to grow by 9% to reach 58.2 million in 2021.

According to GlobalData’s Wealth Markets Analytics, the number of affluent individuals in China recorded an average annual growth rate of 9.3% between 2016 and 2020, rising from 36.6 million in 2016 to 53.5 million in 2020. The country is home to the largest affluent population in Asia and the second largest globally, behind only the US.

While China was affected by COVID-19 initially, the country was among the few to have suppressed the virus to a large extent. With negligible infections, a relatively early resumption of domestic economic activity, a stimulus deployed by the government, and increased exports in the manufacturing sector, China was able to sustain a marked rebound in its overall saving and investments market in the second half of 2020.

This supported some of the most robust growth in an affluent population seen anywhere in the world in 2020.

China’s wealth resilience was aided by its heavy bias towards deposits in its retail investment markets, a common-enough feature of developing markets and one that shielded many from the loss of wealth suffered by equity investors elsewhere.

However, GlobalData anticipates a slight shift away from deposits among Chinese investors towards equities and mutual funds once the pandemic subsides completely. The Shanghai Stock Exchange Composite Index recovered from the losses incurred earlier in the year, with the stock market index registering a 13.9% growth in 2020, fuelling an appetite for riskier assets among mainland investors. This will support the rosy forecast GlobalData has pencilled for China in 2021.

This year is expected to be strong for investors, including the affluent Chinese. Even though China began its recovery earlier than the rest of the world, its economy and financial markets will continue to expand, supported by its recent modest financial liberalisation, which increases foreign access to its capital markets.

WealthManagement. Credits:GlobalData