Thought leadership

Thought leadership

Improving quality of client service and profitability: searching for optimal trade-off

???

Client service and experience have emerged as major differentiating factors for financial services firms in recent years. According to McKinsey’s recent study “Customer Journey Benchmark” analysing different types of customer journeys in financial services, digital-first journeys led to higher customer-satisfaction scores and generated 10 to 20 percentage points more satisfaction than traditional journeys. On the other hand, improving the quality of client service leads to its negative counterpart of influencing the cost-to-serve / cost-to-income ratio.

For this reason, Objectway commissioned Compeer the research study “Squaring the circle – ‘how to improve the quality of client service as well as profitability” with the aim of investigating how UK Wealth Management firms can improve the quality of service provided to their clients, at the same time as improving profitability.

Why compeer, why UK

This was not a random choice, as Compeer is recognised as the premier provider of business performance benchmarking for the UK Wealth Management and Private Banking industry, publishing yearly business insights in this segment.

Compeer collected the responses by submitting an online questionnaire and through face-to-face interviews to their network of more than 1000 UK Wealth Managers, Private Bankers, Stockbrokers and Private Client Investment Managers.

UK represented a valid ground to run such a project, because of the higher propensity to equity investments and the financial services market being composed by highly specialised players serving different market segments. While in other territories wealth management is often managed by firms providing a variety of banking services, the specialisation of the UK market made it a perfect candidate for investigating its dynamics.

From that, comes the fact that the research study results can be assumed as the forthcoming trends to look at in the other regions in which we operate, as they'll outline the future direction for the next strategic decisions and investments to better serve our customers.

Highlights from the examined research areas

Multiple research areas have been investigated to depict a comprehensive picture of the current and desired trade-off between profitability and quality of client service in the UK Wealth Management and Private Banking Industry.

Background to the Firm

The firms interviewed were most frequently aiming to grow assets under management by up to 15% on an annual basis over the next three years, which could mean a doubling of assets over 5 years. Current profit margins were on the whole in line with the industry average of 25%.

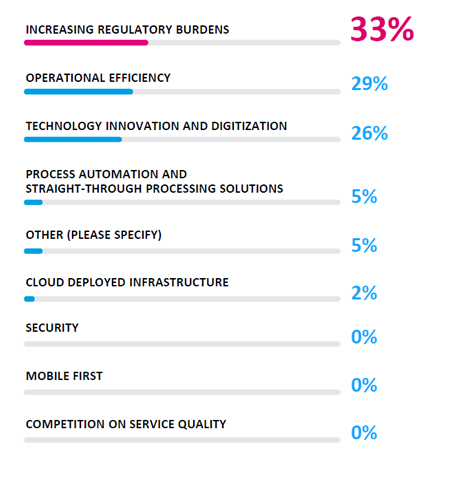

The primary areas mentioned as those affecting margins were regulatory burdens, operational efficiency, and technologyinnovation and digitisation (fig. 1).

Fig. 1 – Please rank the 3 main driving forces impacting your Cost-to-Income ratio

Increasing regulatory burdens being the main driving force impacting cost-to-income ratios for 33% of all respondents is not surprising, given the ongoing MiFID II and GDPR regulatory projects with implementation dates in the first half of 2018.

Operational efficiency is a driving force for many firms in the industry. As emerged from other Compeer’s research, on a departmental level, operations and IT costs represented 18.2% of all costs. For some firms, operations costs can represent even 25% of revenue.

Technology innovation and digitalisation was another area impacting the ratio, in line with another recent finding from Compeer research conducted in early 2017, where 70% of firms affirmed they were looking to increase their technology spend by 20%-50% per annum in the next 3 years.

Quality of Service

The majority of respondents were measuring client centricity, in some way or another, primarily through client surveys. Areas where interviewees could see room for improvement in the quality of service included digitalisation, more contact time with clients, and technology improvements other than digital.

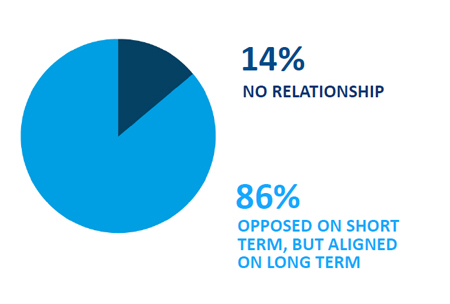

Two thirds of interviewees have experienced quality of service initiatives that impacted the cost-to-income ratio. But 86% of firms stated that such initiatives are opposed to improvements in the profit margin in the short term, as initial investments in quality of service will involve a monetary outlay and increase the cost-to-income ratio. In the long term, anyway, such investments in the quality of service can lead to improved client retention and acquisition, thus higher revenue and higher profit margins (fig. 2).

Fig. 2 – Is Quality of Service opposed to Cost-to-Income ratio improvements or do they go hand in hand?

Improving Profitability

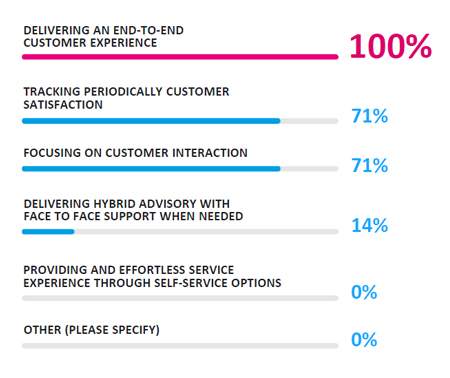

For quality of service, all firms interviewed declared they are delivering an end-to-end customer experience, while 71% additionally periodically tracked customer satisfaction or focussed on customer interaction (fig. 3).

Fig. 3 – How do you serve your customers? (multiple choices allowed)

Although half of firms interviewed did not know how much their IT and operations costs were as a percentage of revenue, the majority were aware their IT spend would have increased in the next 3 years. Coherently, when asked to specify the ways by which they were planning to reduce cost-to-serve in the next two years, almost all respondents focused on internal efficiencies in both the front and back office.

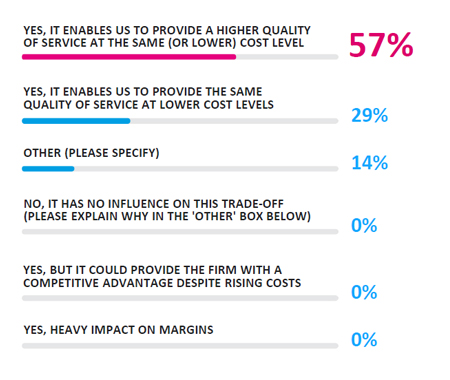

All of the firms surveyed will then invest in digital, which could be explained by the fact that 86% of interviewees believed that digital could provide either an improved quality of service at the same or lower cost, or the same quality of service but at a lower cost (fig. 4).

Fig. 4 – Does digital technology change the historic trade-off between Quality of Service and Cost-to-Income ratio?

Contact

Chiara Giudici

Objectway Group