MONEY

regulation

Asian emerging markets outlook: Which one will you put your money on?

India is facing a contentious election. And China trade tariffs from the US. Is the party over for Asia’s fastest growing economies? Oliver Williams talks to emerging market specialists about their prospects for the year ahead.

India is facing a contentious election. And China trade tariffs from the US. Is the party over for Asia’s fastest growing economies? Oliver Williams talks to emerging market specialists about their prospects for the year ahead.

“This year has been a challenging year for my portfolios,” Daryl Liew, head of portfolio management at REYL Singapore told PBI. “Asian markets have been hammered one after another.”

While there are some macro forces that have collectively ‘hammered’ Asian markets in the last year – notably a strong US Dollar and falling oil prices – the biggest economies have responded individually.

Growth in both India and China has slowed for different reasons. But outside these markets there is growth to be found. And even within in the behemoth economies of India and China there are opportunities, if you look hard enough. PBI talks to several emerging market specialists who have done just that.

China: Tariff tainted

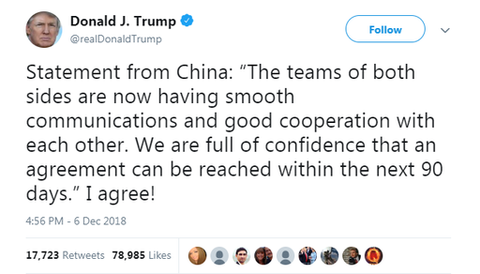

Trade between the US and China has stolen the headlines in 2018 as tit-for-tat tariffs have been labelled a ‘trade war’.

This is overdoing it say some. “Its not about trade… its about who’s going to be the economic and political leader of the world in 10, 15, 20 years time,” says Norman Villamin, chief investment officer (private banking) for Union Bancaire Privée (UBP). “Its about technology and who’s going to dominate that landscape.”

This is a view also held by Liew: “My theses on this is it’s not about trade. It's about tech leadership. It's about intellectual property.”

While theories and thesis might seem a bit grand to the mere HNW investor, they at least give some indication on the timeline of tariffs.

But opinion differs as to how this will affect markets. “I don't see how this can be resolved any time soon. These tensions are going to remain for quite a while,” says Liew.

“We believe China is going to stabilise. Maybe it picks up a little bit,” is Villamin’s assessment for 2019.

Others believe that markets will adjust to a new normal. Ewan Thompson, the co-head of emerging market equities at Neptune Investment Management, calls this ‘tariff fatigue’: “The China currency deprecation has offset the cost of tariffs…Trade values have been stable. There is an element of tariff fatigue.”

There is evidence that investors are adjusting to this new normal. “The interesting thing is over the last few months the Shenzhen and Shanghai stock exchanges have been net positive. Which means to say international investors are buying into that, they're buying into China right now,” says Liew.

But investors will want to be selective of their stocks. The recent arrest of Chinese telecoms executive Meng Wanzhou in Canada has sent the shares of her company – Huawei – spiralling. This is front line in a tech – not trade – war is highly unpredictable. “Nobody could’ve predicted this”, says Villamin.

Huawei: On the front line of a tech – not a trade – war

India: Democratically doomed?

Asia’s other major economy – India – is not fairing much better economically. It may be immune to trade tensions, but is prone to democracy.

India’s 2019 election could be the largest democratic undertaking the world has ever seen as a high turnout is anticipated in the world’s largest democracy.

At the time of writing most polls are almost even. “I don't think its certain that [prime minister] Modi will get through. One of the things that he's done is he's pushed opposition together. Whereas in the past they've been very fractured they've now come together because of him,” says Liew.

Added to this uncertainty is a disagreement between Modi and the reserve bank of India, which has seen two of its governors quit in the past year.

So what does 2019 have in store for Asia’s third largest economy? “What’s changed is that income levels are rising,” says Gaurav Narain, head of equities at Ocean Dial. “That means a consumer economy whose growth is not yet realised.”

GDP matters here, says David Cornell, the CIO and managing director of Ocean Dial: “The point about that is its consumption coming off a very low base. GDP per capita is $2,000 a head. Mexico is about $8,000 a head. India is today where Mexico was 36 years ago. But its population is tenfold.”

And while “India’s large-cap stocks have a lot of obstructions,” reckons Liew. Small and mid-caps are holding up.

“Mid-cap stocks over time tend to perform better than large cap stocks,” says Cornell. “Since 2003, India mid-caps have compounded at 17.7% in Dollar terms every year for the last 15 years. That compares with China at about 7.7%, Brazil at about 11%, Mexico at about 12%, South Africa at about 9%.”

But will the double-digit growth continue? Much of this depends on the outcomes of April’s election.

“It is imperative that any of the governing blocks achieve parliamentary majority or a strong working coalition for businesses and markets to function unperturbed,” says Udit Garg, head of wealth management at Sun Global Investments.

Prime Minister Narendra Modi seeks re-election in April.

Thailand: Asia’s dark horse

Lloyds Private Bank has named Thailand ‘Asia’s dark horse’ and its ‘one to watch in 2019’.

“Private consumption in Thailand is improving, led by passenger car sales. The Thai Baht is resilient and the annual bank loan growth rate is on the verge of rising above 10% while non-performing loans are less than 3% of the total,” Lloyds Private Bank said in their annual Investment Outlook.

“I think Thailand is a very interesting market,” Alvin Lee Han Eng, the head of group wealth management at Maybank Berhad, recently told PBI. “Thailand is one of the only markets in the region that is not part of CRS [Common Reporting Standards] so a lot of discerning, tax savvy, investors do want to move some money there.

“The one caveat is Thailand has quite a lot of coups. But it’s way of life.”

Coups are a “way of life” in Thailand. Should investors care?

Vietnam: Trade war winner?

While trade tariffs between the US and China have been seen with scorn in much of Asia, that is not the case in Vietnam says Liew: “It is a potential beneficiary of the trade war… there's a number of companies that are shipping the manufacturing out from China to elsewhere in southeast Asia, and Vietnam is one of the few beneficiaries.”

This view is also held by Piotr Zboinski, a senior manager at Orbium, a management consultancy. “These trade wars have particular consequences. One is, if you look at manufacturing, what you have is outsourcing out of China into Vietnam.”

Vietnam also has a huge consumer potential that has not yet been realised, says Zboinski: “There’s this large chunk of the population that has entered the job market and are earning money and spending that money. It is driving everything. The demand for apartments… In 5 years time we will see a boom in the medical centre. All those 24, 25 year olds will settle down and start families.”

Is Vietnam the winner of the trade war?

And the rest

While China, India, Vietnam and Thailand all have risks and opportunities of their own, they are often in sync with the other Asian emerging markets absent from this article. All are watching the US Dollar as it sets the scene for local currencies. But for how much longer? Two experts provide their “de-s”:

Liew speaks about ‘de-dollarisation’: “The fact that the US is slapping sanctions on Iran on Russia is actually pushing them away from the Dollar and forcing them to look for alternative currencies which is one positive on the Renminbi.” The outcome of this, Liew believes, will be that Asian currencies start to take reference from the RMB rather than USD.

Patrice Gautry, chief economist at UBP, believes in a ‘de-synchronisation’ of global markets. “We have different views of monetary policy and different views of the fiscal situation. So it means a lot of opportunities and a lot of volatilities”.