- ECONOMIC IMPACT -

Last Updated December 2022

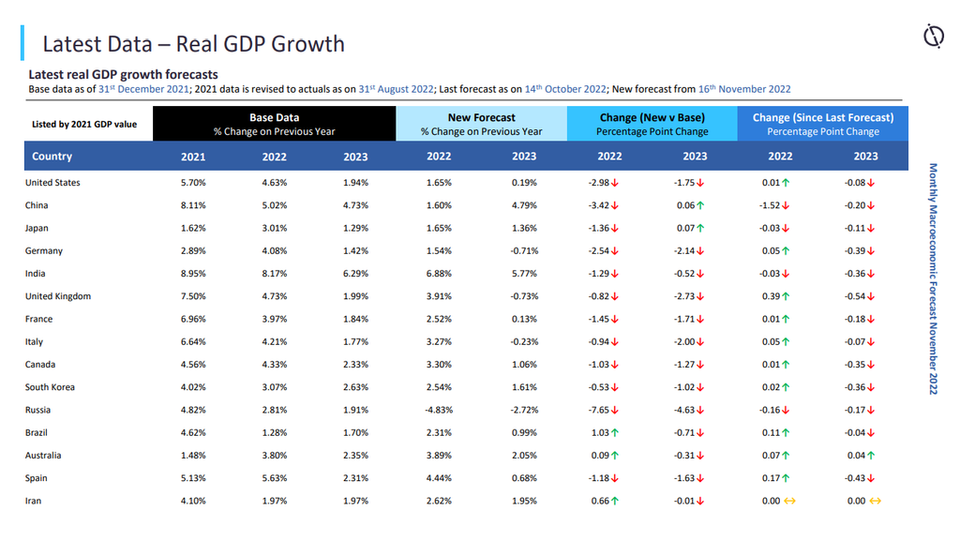

The US: In October 2022, the US inflation eased to the slowest pace since January 2022, indicating that while inflation is still a concern for the US economy, pressure could start cooling down. According to the data from the US Bureau of Labor Statistics, the consumer price index for all urban consumers (CPI-U) stood at 0.4% month-on-month (MoM) and 7.7% year-on-year (YoY) in October 2022. The core CPI, which excludes the volatile prices of energy and food, reached 6.3% YoY in October 2022. During the current monthly revision exercise, the real GDP growth for 2022 and 2023 is forecast at 1.65% and 0.19%, respectively.

Japan: According to the data from the Statistics Bureau of Japan, the Consumer Price Index increased to 103.1 points in September 2022 from 102.7 points in August 2022. The CPI increased 3.0% YoY in September 2022, exceeding the central bank’s target of 2% for the sixth consecutive month. The current increase in prices is the result of increasing import costs rather than strong demand as the yen continued to depreciate and reached a 32-year low. The Producer Price Index increased 0.5% MoM and stood at 117.5 points in October 2022. The Export Price Index and the Import Price Index also grew MoM by 1.2% and 0.1%, respectively, in October 2022. During the current monthly revision exercise, the real GDP growth for 2022 is forecast at 1.65%, while for 2023, it is forecast at 1.36%.

China: While inflation has been increasing in the US and Europe, the Consumer Price Index (CPI) in China remained subdued due to lack of domestic demand. According to the National Bureau of Statistics (NBS), the CPI rose 2.1% YoY and 0.1% MoM in October 2022. On a yearly basis, food prices increased 7% and non-food prices increased 1.1% in October 2022. The prices of food, tobacco and alcohol rose 5.2% YoY in October 2022 owing to an increase of 1.43 percentage points in CPI. During January– October 2022, CPI increased 2% in comparison to that in the corresponding period of last year. On a YoY basis, the Producer Price Index (PPI) for manufactured goods decreased 1.3% and increased MoM by 0.2% in October 2022. Signs of weakness in economic performances are emerging from across the country, prompting policymakers to implement more stimulus measures as the monetary easing and infrastructure spending had very little effect on China’s economy. The country needs to put greater focus on fiscal policy stimulus owing to the near-term concerns over zero-COVID policy and the long-term issue of domestic demand. During the current monthly revision exercise, the real GDP growth for 2022 is forecast at 1.60%, while for 2023, the country is forecast to record economic growth of 4.79%

Russia: According to the data from the Central Bank of Russia, inflation rate stood at 12.6% in October 2022. According to the data from the Federal State Statistics Service, the Consumer Price Index stood at 100.18 points in October 2022. Consumer prices increased 0.3% or more in 47 constituent entities of Russia. The largest increase of 2.1% was recorded in the Nenets Autonomous Okrug (due to an increase in the cost of non-food products by 3.5%). It decreased in nine regions of Russia, with the major decline in of 0.4% in the Republic of Adygea. The prices of motor gasoline increased in nine constituent entities and decreased in nine constituent entities of Russia during November 1–7, 2022. A major increase in gasoline prices of 0.3% was reported in the Republic of Tyva and Udmurt Republic, and a major fall of 0.8% was reported in the Kirov region. During the current monthly revision exercise, the real GDP growth for 2022 is forecast at -4.83%, while the country is forecast to grow at -2.72% in 2023

-4.4%

IMF has revised its 2020 global GDP forecast to -4.4% from an estimate of -4.9% made in June.

5.3%

The global economy is estimated to contract by 4.2% in 2020 and bounce back by 5.3% in 2021.

- Executive Summary: Cloud computing -

Last Updated December 2022

Clinical trial market impact

1,032

Trial disruption is leveling off and disrupted trials saw a small dip, with 1,032 trials still disrupted and 579 pharma/biotech companies and contract research organisations associated with disrupted clinical trials.

3,414

There are currently 3,414 clinical trials underway for Covid-19, including 172 multinational trialsroboto slab and 2,818 single-country trials.

Cloud computing’s importance has grown significantly in recent years. It has allowed shared IT infrastructure and services to create a flexible, scalable, and on-demand IT environment. The cloud is now the dominant model for delivering and maintaining enterprise IT resources, including hardware, software, and platforms and tools for application developers.

Cloud computing provides users with an approach to consuming IT that is significantly more flexible, resource-efficient, and cost-effective than traditional IT. Cloud-based IT resources can be delivered privately, for use by one or a specific group of enterprises, or publicly, where IT resources are accessed according to multi-tenancy principles.

Hybrid cloud environments, which combine the use of both public and private cloud, are increasingly popular among enterprises that want to enjoy the benefits of both. The widespread move to home-working necessitated by COVID-19 would have brought businesses to a grinding halt had investments in cloud not been made over the last 10 years. That investment now has the potential to transform the way some businesses operate.