Strategy

UK recession: First in, last out?

The UK seems to be the first major economy to enter recession, and could be the last to exit. We explore the reasons behind lackluster performance and conclude that despite an unpalatable economic scenario unfolding, investors can find opportunities. Frédérique Carrier, head of investment strategy in the British Isles and Asia at RBC Wealth Management, writes

T

he UK seems to be the first of the major advanced economies to enter recession.

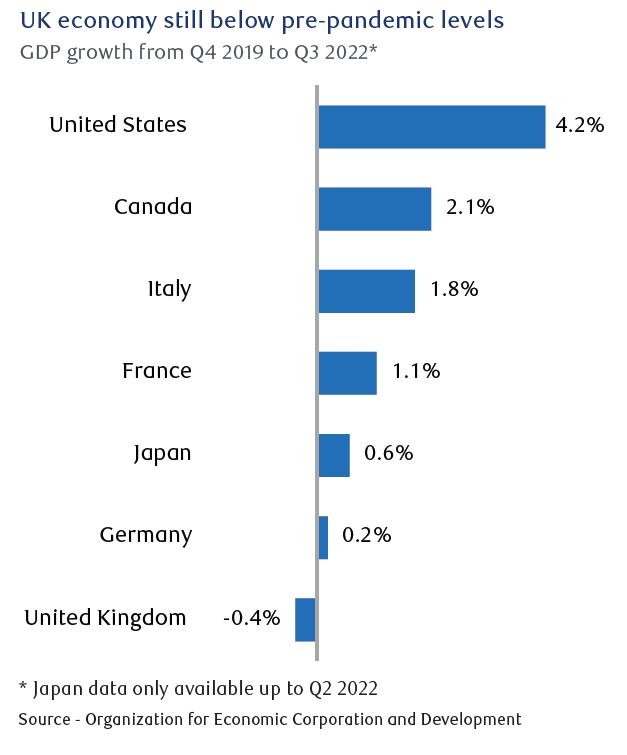

It is not doing so in a position of strength, as it is the only G7 economy still languishing below its pre-pandemic output levels, having had to contend with the economic shocks of Brexit and this year’s energy crisis in addition to the impact of COVID-19.

In Q3, the UK’s GDP contracted by 0.2 percent q/q, with retail sales falling both in August and September. Lead indicators for October also point to a slump. Consumption, the economy’s main driver, is sputtering as a crippling cost-of-living crisis, with inflation exceeding 11 percent, takes its toll on consumers.

Prolonging the pain

More challenges are in store, as the government has announced sweeping spending cuts and tax increases, even as the Bank of England tightens monetary policy. Newly appointed Prime Minister (PM) Rishi Sunak is imposing austerity in an effort to restore credibility after his predecessor Liz Truss’ fiscal recklessness increased UK assets’ risk premium. Sunak’s austerity measures, which are projected to total around 1.9 percent of GDP over the next five years, aim to get the nation’s debt-to GDP ratio—which stood at roughly 103 percent as of the end of 2021—falling at a comfortable pace.

Meanwhile, the Bank of England (BoE), the first major central bank to embark on a tightening cycle back in 2021, has raised interest rates to three percent so far. With a more prudent fiscal policy in place, we think the BoE will likely be less aggressive going forward. RBC believes the Bank Rate will reach 3.75 percent at the end of the current tightening cycle, less than the 4.9 percent consensus estimate.

Higher interest rates are already having an impact on the housing market. Mortgage financing tightened markedly as a result of the ill-fated fiscal expansion announced by Truss in September. Mortgage rates have since retreated, but remain elevated. In the UK, some 30 percent of mortgages are fixed for two years and will be coming up for refinancing at much higher rates. Surveys, including a recent one by UK real estate website Rightmove, suggest property prices are declining.

With UK consumers particularly sensitive to the housing market, this suggests the BoE’s efforts are having the intended effect of decelerating demand.

Deregulation is no panacea

Government hopes that getting rid of EU regulation would give industry a shot in the arm are proving unfounded so far. Reviewing 50 years of EU regulation is an enormous task; PM Sunak has backed away from his ambitious proposals to complete the exercise within 100 days of assuming the premiership. Moreover, business groups such as the Confederation of British Industry have warned that deregulation for its own sake could add extra costs to companies already facing difficult economic times, according to the Financial Times. The result of all this will likely be a long-drawn-out recession. Consensus economic forecasts for the UK point to a contraction of 0.5 percent in 2023, but with downside risk as the impact of austerity gets incorporated into forecasts. The recession could last well into 2023. A more cautious monetary policy will mean tolerating sticky inflation and a weaker pound, in our view.

Change of tack needed

Decisions taken by policymakers (fiscal recklessness followed by austerity in a recession) and by society at large (Brexit) have put the UK economy on a difficult path. In our view, the economy will eventually recover, but a change of direction would likely help it improve sooner.

Such a change may be emerging. Sunak differs from his three predecessors since 2016 in that he doesn’t seem bent on taking an adversarial stance against the country’s major trading partner, the EU. In early November, Sunak became the first PM since 2007 to attend a British-Irish Council Summit, and a bilateral summit with France has been announced for Q1 2023. A solution to the dispute over the Northern Ireland Protocol, the customs procedures designed to avoid a hard border on the island of Ireland since Brexit, would go some way towards reducing the uncertainty which has affected investment since the UK voted to leave the EU in 2016, in our view.

Low valuations, high dividends

With austerity making economic conditions more challenging, we maintain our Underweight recommendation for UK equities as part of a global portfolio.

However, we think there remain attractive opportunities in UK equities, which are trading at a historically large valuation discount to other markets, even accounting for differences in sector composition. For income-seeking investors, the FTSE All-Share Index has the highest dividend yield among the major regional equity markets, at over four percent.

We maintain our strong bias for internationally oriented companies. The valuation multiples of many leading UK-listed multinationals are now significantly lower than peers listed in other markets. Despite their strong outperformance in 2022, we believe that Energy companies in particular remain attractively valued, given the prospect of oil and gas prices remaining higher for longer. We would continue to be selective towards domestically focused UK stocks given our cautious stance on consumer spending.