COVID-19 pandemic has encouraged a DIY approach among UK investors

Historically, discretionary services were the clear leaders in terms of asset distribution by mandates for UK HNW wealth. However, UK HNW investors are now becoming more hands-on with their investment styles amid the COVID-19 pandemic. GlobalData Financial Services writes

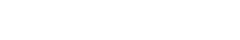

Like most European countries, GlobalData’s2020 Global Wealth Managers Survey found that discretionary mandates still lead the race for the largest percentage of UK HNW wealth at 24.8%. But they are no longer as far ahead as they once were.

They edge out execution-only mandates by just 0.1 percentage points, while advisory mandates are not far behind. The real underdog is automated investment services, as this decade-old asset management style is now accounting for almost 15% of HNW wealth in the UK. The market has become significantly more diversified, and players should accommodate these varied needs to hold on to clientele.

The days when many UK investors would trust their advisor to make their investment decisions without consultation are fading away. Clients are increasing their own investment management knowledge and are becoming more prone to a DIY approach. Wealth managers need to accommodate this growing desire for control. They also must ensure relationship managers provide the necessary reassurance to retain faith in the expertise of the investment team.

Looking ahead, our data suggests that discretionary mandates will see the least growth and advisory asset management is expected to see the most growth in the future. So although clients are wanting the final say on their investment decisions, they still welcome the expertise of wealth managers when they need it. The COVID-19 pandemic has caused a very unstable financial market, so advisors will be commended for helping their clients jump over hurdles in this time.

The wealth management industry in the UK is in a transformational period. Wealth managers will come out successful if they can meet the more varied needs of their investors, whether it is providing automated investment services or supporting clients as they take the reins of their portfolios. Those that fail to adapt to shifts in investor preferences will suffer unhappy clients and lower retention rates at a time when social distancing makes getting new clients more of a challenge than usual.