Thought Leadership

Sponsored by additiv

Capitalising on embedded finance – there's a wealth of opportunities!

What if you could reach a largely untapped market, and add a new profit line, without having to develop new services or spending millions on capex and opex? It's not a rhetorical question, or blue-sky thinking. There's a significant revenue opportunity right there for the taking, and it's called embedded wealth.

A $100 billion revenue opportunity

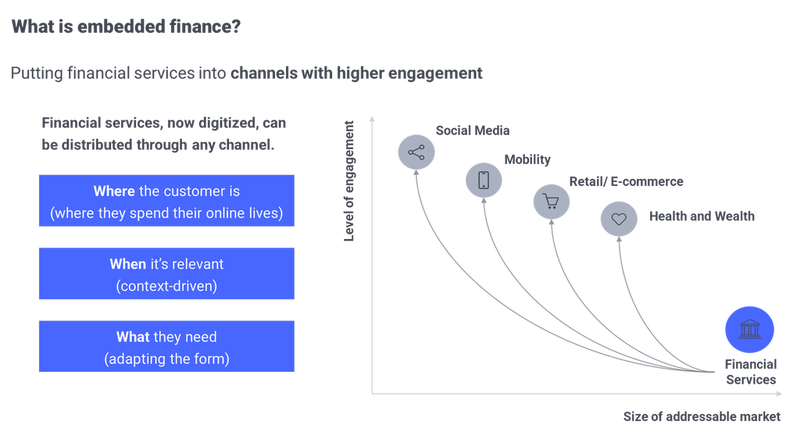

Embedded finance is one of the most important trends in fintech. It refers to the business model whereby financial services, now digitized, can be offered through any distribution channel. And while most of the buzz around embedded finance is centred around payments, at additiv, we think it will have a far more profound impact on wealth management. This is referred to as ‘embedded wealth’.

As things stand, $33 trillion of the world's investable assets aren't professionally managed. That means a huge number of people aren't growing their wealth or taking steps to secure their future. Assuming an average 30 basis points for wealth managers and their partners, there’s also about $100 billion in fees being left on the table.

So why is embedded wealth such a game-changer?

And why should banks get in on it sooner, rather than later?

The future of aviation is strictly tied to several factors

Power to the people

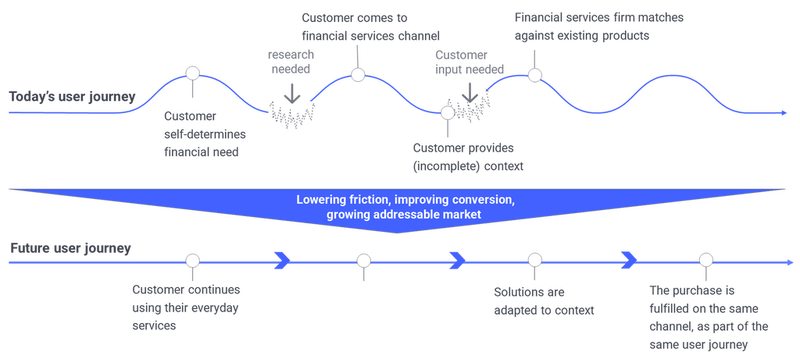

The most exciting thing about embedded wealth is that it bringing wealth management services to a customer’s point of need; through an existing channel and an existing user journey.

Source: additiv

Traditionally, when customers needed wealth management services, they'd have to understand their need and find their right solution. This involved researching what products were available and choosing from a selection of often highly standardized products.

Then, once they made their choice, customers had to jump through several hoops to get onboarded.

It's a journey that's fraught with friction and which, consequently, many customers abandon out of frustration.

According to The Battle to Onboard, a study of attitudes towards financial products, 63% of European customers never finish a financial product application, mainly because they find the process too long and cumbersome.

Even among those who already use wealth management services, there's growing appetite for change.

In 2019, 82% of respondents to a survey said they expect every digital experience to be at least as good as that of tech giants like Google and Amazon, but the wealth management industry is still falling short.

If anything, Covid-19 has raised the stakes. Customers have increasingly high expectations when it comes to the quality of digital banking experiences. And the pandemic's economic fallout has also put them under more pressure to make their money work harder.

By contrast, embedded wealth - which refers to offering wealth management services by embedding these into third-party channels and into existing user journeys – puts a relevant product in front of the customer when it makes sense to do so, on the channel where it makes most sense.

Source: additiv

This has several advantages over the traditional model:

It's more convenient. This is because the solution is presented at a customer’s point of need. In fact, the customer may not even realize they need the product. Proactively presenting them with it in a relevant context adds value by anticipating those needs.

It reduces friction. The product is part of an existing user journey, so the customer doesn't have to switch channels. And because the channel on which the product is offered already has a lot of data about the customer, onboarding is quicker and simpler.

It’s a tailor-made product. With embedded wealth, products can be designed around customers' needs. Plus, the customer data can also ensure that the product offered is more relevant and therefore more valuable.

Why start offering embedded wealth?

There are three main reasons for banks to start offering embedded wealth.

Firstly, it's an opportunity to broaden the range of product and services that they offer to enable the upselling and cross-selling of high value financial products to customers who might not have considered them. This may be due to either lack of interest or because they perceive buying such products as being too difficult.

Case in point, personal pensions, life insurance, and other retirement products are inflexible and siloed. Meanwhile, according to Eurostat, the pensions deficit is growing, to the point where close to two-fifths of older people who live alone can't afford unforeseen expenses. As a result, consumers are looking at a wide range of products to prepare for their future, including wealth and investment services.

Secondly, embedded wealth enables platforms to access an untapped market for wealth management services - a younger, more engaged audience.

When you log on to your banking app, you usually do so to complete a task -checking your balance or paying a bill, for example - and then you log off. It's unlikely you'll hang around, which makes up-selling and cross-selling more difficult.

By embedding wealth management products, banks can capitalize on high client engagement to actively propose investment services to customers. They can also grow their addressable market by taking advantage of access to younger demographics.

In addition, they can leverage interactions plus large data sets to personalize and adapt investments to customer context (roundups, loyalty points, cashback etc), increasing sales conversion rate.

Thirdly, offering embedded wealth products makes acquiring customers far less costly.

Over the past decade, digitalization and the proliferation of consumer platforms have lowered the barriers to entry, even in industries with traditionally prohibitive start-up costs like banking.

This has given customers more choice, but also put a premium on their attention span. As a result, ensuring customers remain profitable is increasingly a challenge – particularly for banks who offer a limited range of services. In fact, the cost of customer acquisition is now thought to be $1,500 on average per customer. It has therefore never been more important to ensure customers (new or established) are (and remain) profitable.

Embedded wealth means that, instead of working to attract customers, banks can focus on creating highly targeted products and offer these when customers are already engaged and/or identified as needing them.

The same wealth product can also be distributed across a whole range of offerings, so platforms can generate large volumes of business more quickly and at lower cost.

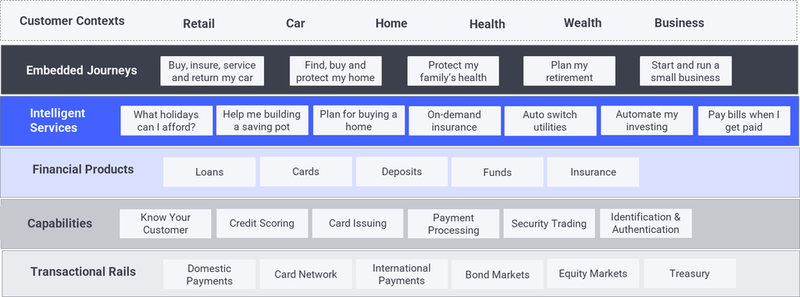

Source: additiv, adapted from 11:FS

Bringing embedded wealth products to life

So banks have a lot to gain from embedded wealth: greater up-selling and cross-selling opportunities, new and high-value revenue streams, and greater customer retention and trust through tailor-made products they can buy with minimal friction.

But how can banks embed wealth services into a third party's user journeys?

One option is to go the way of Standard Chartered and Goldman Sachs and build your own platform leveraging API technology. But while this gives you complete control, it's easier said than done.

APIs must work seamlessly on disparate systems. But banks' expertise lies in creating innovative financial products, not in developing technological applications.

More to the point, building your own wealth products is usually a costly activity and requires significant time investment. Goldman Sachs' Marcus, for instance, was originally launched as a customer-facing app in 2016. It's taken five years, several iterations, and an undisclosed investment (probably in the hundreds of millions), for the app to get to where it is now.

The case for providing embedded wealth services through a BaaS platform

However, there is another way.

At additiv, we've partnered with Saxo Bank to create an end-to-end platform that lets banks plug in and get instant, global access through one intuitive, user-friendly interface. This model – commonly known as Banking-as-a-Service (BaaS) – enables platforms to launch embedded wealth products and expand reach quickly at minimal cost, while staying in control.

Through our partnership with Saxo Bank, we can provide access to execution and custody capabilities, and world class international brokerage and custodian services with access to a huge range of investment products across several markets. These include 19,000 stocks on 37 exchanges, 3,100 exchange traded funds, and notes, mutual funds, and bonds from 26 countries.

In addition, those embedding their services into their platform get access to business-critical admin services — including compliance reporting, liquidity management, custody and back office.

Enabling Saxo Bank’s products to be embedded into a bank’s channel to offer wealth management services, is additiv's orchestration platform which:

Manages complex operational and logistical issues.

Provides a system of intelligence that can handle a seamless customer journey - digital onboarding, customer relationship management, order handling, and advice - to the digital customer experience standards customers have come to expect.

Brings a suite of essential services together into a set of standard APIs.

We're also constantly growing our ecosystem of trusted partners, including ones that provide financial and pension planning analytics and Environmental, Social and Governance (ESG) investment data.

Put simply, working with us means banks can concentrate on what you do best: developing innovative financial products, without having to worry about technological implementation challenges or back-office admin.

Our sophisticated platform and market-leading partners will help you bring it all together.

And because those financial institutions embedding Saxo Bank’s products can bring insight into every aspect including delivery mechanism, product enhancements etc. This has driven product enhancements, along with requests for specific tools and functionality. It’s a win/win situation.

Ready or not, embedded wealth is coming

When the fintech revolution started in the late 2000s and early 2010s, it was about increasing accessibility and improving banking services. But the services and their providers remained largely unchanged.

With the rise of embedded wealth, that's about to change.

In the coming years, Finance is going to be all about providing the right service, at the right time, on the platform that makes most sense to the customer.

Savvy banks can offer a far wider range of products to more customers, including people to whom it may have never occurred to purchase a wealth management product, at much lower cost, and greatly increase their revenue by embedding wealth management products into their platform.

But if you really want to make the most of the $100 billion revenue opportunity, you need to start today.

Working with additiv can help you ensure you're leading the way, instead of looking in from the side-lines.

To find out more contact us or download our recent embedded wealth report: www.additiv.com/thought-leadership/embedded-wealth-management

Contact details

Additiv AG

Riedtlistrasse 27

8006 Zürich

Switzerland

+41 44 405 60 70

webcontact@additiv.com