DEALS ANALYSIS

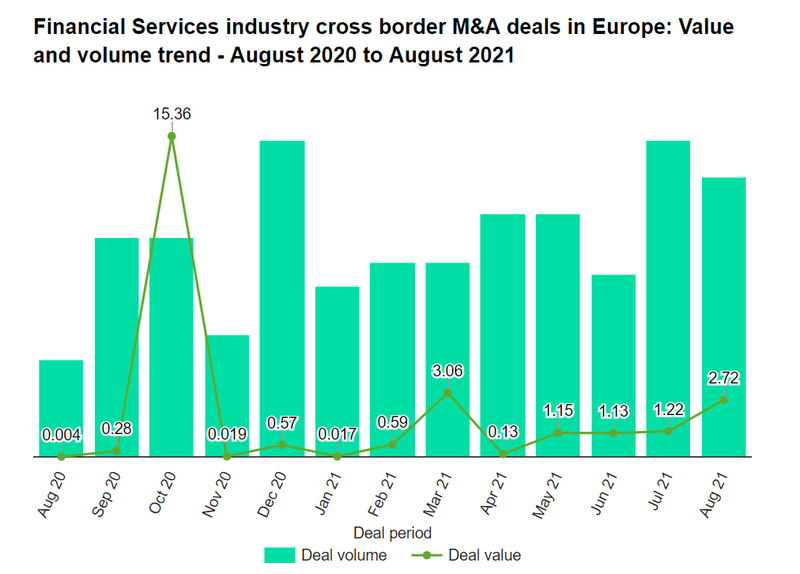

Financial Services industry cross border M&A deals total $2.7bn in Europe in August 2021

Total financial services industry cross border M&A deals worth $2.7bn were announced in Europe in August 2021, led by Apex AcquisitionLimited’s $2.07bn acquisition of Sanne Group, according to GlobalData’s deals database.

The value marked an increase of 123% over the previous month of $1.22bn and a rise of 38.8% when compared with the last 12-month average of $1.96bn.

Europe held a 6.29% share of the global financial services industry cross border M&A deal value that totalled $43.26bn in August 2021. With a 6.06% share and deals worth $2.62bn, the UK was the top country in Europe’s cross border M&A deal value across financial services industry.

In terms of cross border M&A deal activity, Europe recorded 23 deals during August 2021, marking a decrease of 11.54% over the previous month and a rise of 27.78% over the 12-month average. The UK recorded seven deals during the month.

Europe financial services industry cross border M&A deals in August 2021: Top deals

The top five financial services industry cross border M&A deals accounted for 98.1% of the overall value during August 2021.

The combined value of the top five financial services cross border deals stood at $2.67bn, against the overall value of $2.7bn recorded for the month.

The top five financial services industry cross border M&A deals of August 2021 tracked by GlobalData were:

1) Apex AcquisitionLimited $2.07bn acquisition deal with Sanne Group

2) The $314.83m acquisition of Shenzhen Investment International Capital Holdings Infrastructure by Mei Wah Industrial (Hong Kong)

3) Federated Hermes $160.52m acquisition deal for 29.5% stake in Hermes Fund Managers

4) The $84.05m acquisition of Coinify by Voyager Digital Holdings

5) DeFi Technologies $37.05m acquisition deal with DeFi Yield Technologies

Financial Services industry M&A deals total $10.5bn in US in August 2021

Total financial services industry M&A deals worth $10.5bn were announced in the US in August 2021, with Brookfield Asset Management Reinsurance Partners' $5.1bn acquisition of American National Group being the sector's biggest investment, according to GlobalData’s deals database.

The value marked an increase of 57.5% over the previous month of $6.64bn and a rise of 178.9% when compared with the last 12-month average of $3.75bn.

The US held a 21.13% share of the global financial services industry M&A deal value that totalled $49.5bn in August 2021.

In terms of M&A deal activity, the US recorded 75 deals during August 2021, marking a decrease of 1.32% over the previous month and a rise of 5.63% over the 12-month average.

US financial services industry M&A deals in August 2021: Top deals

The top five financial services industry M&A deals accounted for 96.9% of the overall value during August 2021.

The combined value of the top five financial services M&A deals stood at $10.14bn, against the overall value of $10.5bn recorded for the month.

The top five financial services industry M&A deals of August 2021 tracked by GlobalData were:

1) Brookfield Asset Management Reinsurance Partners $5.1bn acquisition deal with American National Group

2) The $3bn acquisition of The Hagerty Group by Aldel Financial

3) GuideWell Mutual Holding $900m acquisition deal with Triple-S Management

4) The $696m acquisition of Alliant Capital by Walker & Dunlop

5) Paysafe Holdings UK $441m acquisition deal with SaftPay